Why Rental Enquiries Are Declining Despite Critically Low Stock Levels

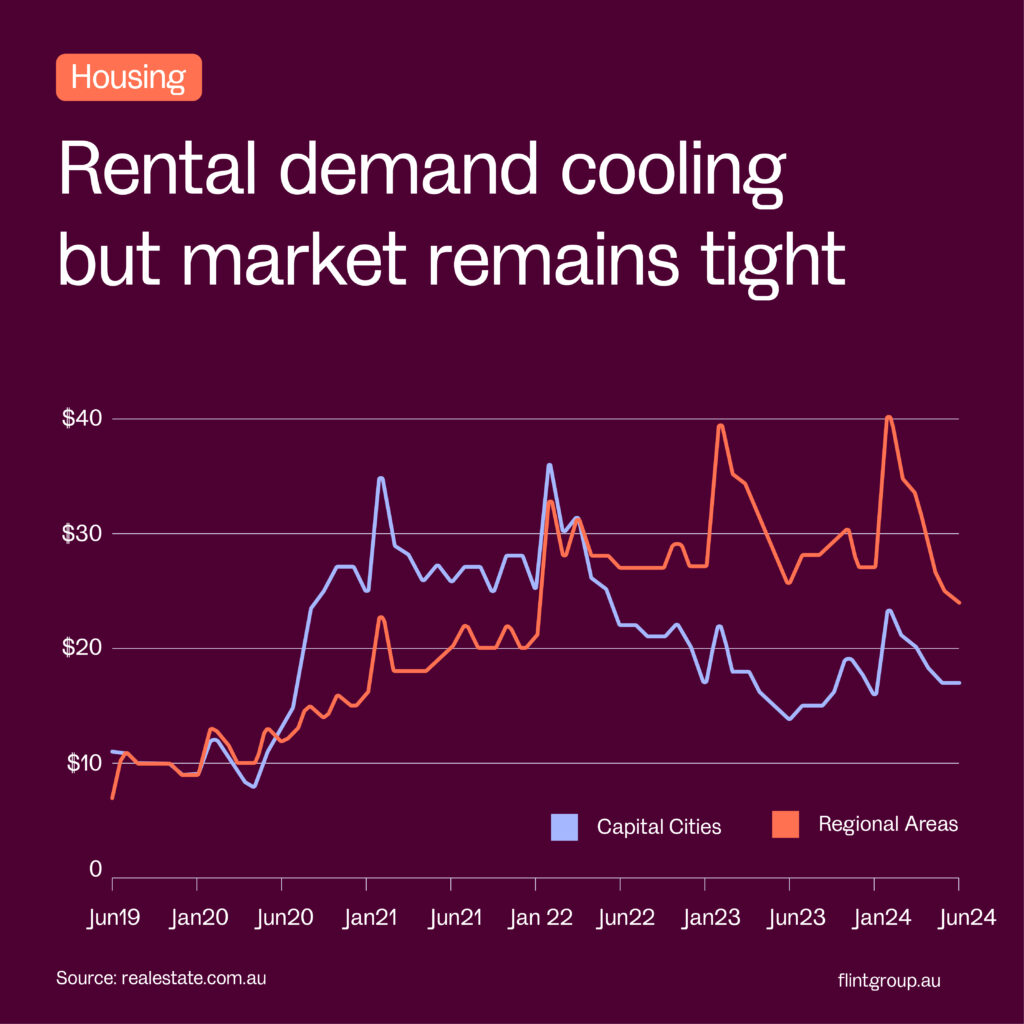

Reading Time: 4 minutesPropTrack data reveals an intriguing trend: the average rental listing in June received 4.6% fewer enquiries compared to the previous year. At first glance, this might suggest that more rental properties have entered the market. However, despite this decline in enquiries, stock levels remain “critically low.” This apparent contradiction begs the question: why are rental enquiries decreasing while rental property availability is still limited? Senior data analyst Karen Dellow offers valuable insights into this phenomenon. According to Dellow, the reduction in rental enquiries can be attributed to the behavior of renters in response to the challenging rental market. Some renters have chosen to purchase properties or move into shared accommodation, thereby reducing the number of individuals competing for the limited pool of rental properties. “Although the pace of growth in the median weekly rent has slowed and the rental vacancy rate has slightly increased, the moderate decline in enquiries per listing might persist as renters opt to buy or share housing due to high rental costs. Nonetheless, rental enquiries are likely to remain high due to ongoing excess demand and limited supply,” Dellow explained. In essence, while fewer renters are inquiring about rental properties, this does not necessarily indicate an increase in available rental stock. Instead, it reflects a strategic shift among renters who are seeking more sustainable and affordable living arrangements. As high rental costs continue to pressure the market, potential renters are increasingly considering alternative housing options, such as homeownership or shared living spaces. Despite the current dip in rental enquiries, the demand for rental properties is expected to stay robust. The imbalance between supply and demand continues to drive the rental market, ensuring that competition for available properties remains intense. Therefore, while fewer enquiries per listing might offer a temporary reprieve for some renters, the overall demand for rental housing is unlikely to diminish significantly in the near future. Understanding these dynamics is crucial for both renters and property investors. For renters, it highlights the importance of exploring various housing options to navigate the high rental costs effectively. For property investors, it underscores the need to stay attuned to market trends and renter behaviors to make informed investment decisions. As the rental market continues to evolve, keeping a close eye on data and expert insights will be essential in anticipating and responding to these changes.

Evolving Financial Habits: Insights from Commonwealth Bank’s 2024 Data

Reading Time: 3 minutesThe Commonwealth Bank (CBA), which boasts the largest pool of bank account data in Australia, has unveiled fascinating insights into how Australians’ earning, spending, and savings habits have evolved amid rising interest rates and inflation. As illustrated in the graph on the left, the average CBA household experienced an income growth of 5.0% over the year to June 2024. This increase was primarily driven by higher salaries, alongside a significant jump in income earned from rental properties and other investments. Conversely, the graph on the right reveals that spending, excluding rent and mortgage costs, rose by just 3.1% year-on-year. However, housing costs grew at a much higher rate, exceeding 10%. “Average savings remain higher than 2019 levels, before the pandemic,” notes CBA. “However, there is evidence that some of these excess savings have been utilized over the past year.” Additionally, CBA reports that “both average loan repayments and average rent payments have risen sharply in recent years. The substantial increase in interest rates since May 2022 has caused average mortgage payments to outpace rent payments. With continued rental growth and fixed-rate rollovers, this trend is expected to persist through 2024.” These insights highlight the evolving financial landscape for Australians, emphasising the impact of economic factors on household financial behaviour.

Understanding Australian Investment Market: Trends and Insights

Reading Time: 5 minutesWe’re committed to helping investors navigate the dynamic landscape of the Australian investment market. With evolving economic conditions and emerging opportunities, understanding the current trends is crucial for making informed decisions. This blog explores the key trends and opportunities in the Australian investment market in 2024. Economic Overview Australia’s economy has shown resilience amid global uncertainties. The GDP growth rate is expected to stabilize, supported by robust consumer spending and a recovery in the tourism sector. Inflation remains a key concern, but the Reserve Bank of Australia’s monetary policies aim to keep it in check, providing a stable environment for investments. Key Investment Trends Market Performance The Australian stock market has remained robust, with a market cap of AU$2.6 trillion as of mid-2024. The performance has been buoyed by strong earnings reports and a stable economic outlook. Key sectors such as technology, healthcare, and consumer goods have shown significant growth, offering diverse opportunities for investors. Opportunities and Risks Opportunities Risks Conclusion The Australian investment market in 2024 presents a mix of opportunities and challenges. By staying informed about current trends and understanding the economic landscape, investors can make strategic decisions to maximize their returns. At Flint Group, we are dedicated to providing the insights and tools necessary to navigate this evolving market.

Starting the New Financial Year: Key Considerations for Refinancing Your Home Loan

Reading Time: 5 minutesAs we welcome the new financial year, it’s the perfect time to reassess your financial health, particularly your home loan. Refinancing can offer numerous benefits, from lower interest rates to reduced monthly payments and access to home equity for other financial goals. Here are some key considerations to keep in mind when contemplating refinancing your mortgage. Reviewing Your Current Financial Situation Before diving into refinancing, it’s essential to understand your financial health. Assess your income, expenses, and existing debts to get a clear picture of your financial standing. This will help you determine if refinancing is the right move for you. Understanding the Benefits of Refinancing Refinancing can provide various advantages: Evaluating Market Conditions The start of the financial year is an excellent time to evaluate current market conditions. Interest rates, housing market trends, and economic factors can impact your refinancing decision. Researching these conditions will help you determine the best time to refinance. Assessing Your Home Loan Terms Review your current loan’s interest rate, repayment schedule, and fees. Identify any features that might benefit from refinancing, such as switching from a variable to a fixed rate or reducing your loan term. Calculating Potential Savings Use online calculators or consult with a mortgage broker to estimate your potential savings from refinancing. Consider different scenarios and see how much you could save on interest, monthly payments, and overall loan costs. Considering Refinancing Costs Refinancing comes with costs, such as application fees, valuation fees, and legal expenses. Weigh these costs against your potential savings to determine if refinancing is a worthwhile investment. Preparing Your Application Gather necessary documents and financial information before applying for refinancing. This includes proof of income, tax returns, and details of your current mortgage. Improving your credit score can also enhance your chances of securing a better deal. Consulting with a Mortgage Broker A mortgage broker can provide invaluable assistance in navigating the refinancing process. They can help you find the best refinancing options, secure competitive rates, and guide you through the application process. Conclusion Starting the new financial year by refinancing your home loan can lead to substantial financial benefits. By reviewing your financial situation, understanding market conditions, and consulting with a mortgage broker, you can make informed decisions that enhance your financial health. Ready to explore refinancing options? Contact our expert team today to discuss how we can help you achieve your financial goals in the new financial year.

Top 10 Benefits of Downsizing for Australian Retirees

Reading Time: 7 minutesTop 10 Benefits of Downsizing for Australian Retirees As more Australian retirees seek ways to simplify their lives and enhance their financial stability, downsizing has become an increasingly popular option. Moving to a smaller home offers a multitude of benefits that extend beyond mere cost savings. Here, we explore the top 10 benefits of downsizing for retirees in Australia, supported by case studies and statistics. 1. Financial Savings One of the most significant advantages of downsizing is the potential for financial savings. Selling a larger home and purchasing a smaller one can free up substantial equity. According to the Australian Bureau of Statistics, retirees who downsize often reduce their housing expenses by 30-40%, allowing for more disposable income to spend on leisure activities, travel, or healthcare. 2. Lower Maintenance Costs A smaller home typically requires less maintenance, which can be both time-consuming and costly. Downsizing reduces the need for extensive repairs, gardening, and upkeep. This not only saves money but also reduces the physical strain associated with maintaining a larger property. 3. Simplified Living Downsizing encourages a simpler, clutter-free lifestyle. With less space to fill, retirees can focus on keeping only what is essential and meaningful. This shift towards minimalism can lead to a more organized and stress-free living environment. 4. Increased Mobility and Flexibility A smaller home can make it easier for retirees to travel or split their time between different locations. Whether it’s spending more time with family or exploring new destinations, downsizing provides the flexibility to lead a more mobile lifestyle. 5. Enhanced Safety and Accessibility Downsizing often means moving to a home that is more suitable for aging in place. Many retirees choose single-story homes or apartments with fewer stairs and more accessible features. This can significantly reduce the risk of falls and make daily activities more manageable. 6. Better Community and Social Life Many retirees choose to downsize into communities that cater specifically to their age group. These communities often offer social activities, clubs, and events that foster a sense of belonging and community. According to a survey by National Seniors Australia, retirees who moved into such communities reported higher levels of social interaction and satisfaction. 7. Environmental Impact A smaller home has a lower environmental footprint. Downsizing can lead to reduced energy consumption and a smaller carbon footprint, contributing to a more sustainable lifestyle. Retirees who downsize often take pride in making environmentally responsible choices. 8. Improved Emotional Well-Being The process of decluttering and downsizing can be emotionally rewarding. Letting go of unnecessary possessions and moving to a more manageable space can alleviate stress and create a sense of accomplishment. Many retirees find that downsizing brings a renewed sense of freedom and peace of mind. 9. Opportunity for a Fresh Start Downsizing offers the chance for a fresh start in a new environment. This can be an exciting opportunity to redesign one’s living space, meet new people, and explore new hobbies and interests. The change of scenery can invigorate and inspire retirees to embrace new experiences. 10. Potential Financial Gains In addition to immediate financial savings, downsizing can provide long-term financial benefits. Retirees can invest the proceeds from the sale of their larger home, potentially increasing their retirement savings. Moreover, the reduced cost of living in a smaller home can lead to substantial savings over time. Case Studies and Statistics To illustrate the benefits of downsizing, consider the case of John and Mary, a retired couple from Sydney. After selling their family home and moving to a smaller apartment, they freed up over $500,000 in equity. This allowed them to travel extensively and invest in their grandchildren’s education. Similarly, a study by the Productivity Commission found that retirees who downsize often report improved financial security and quality of life. In conclusion, downsizing offers a myriad of benefits for Australian retirees, from financial savings to enhanced emotional well-being. By moving to a smaller, more manageable home, retirees can enjoy a simpler, more fulfilling lifestyle. Whether driven by financial necessity or the desire for a fresh start, downsizing is a practical and rewarding choice for many retirees.

Top Features to Look for in Your Next Home: Must-Haves for a Smart Investment

Reading Time: 2 minutesWhen buying your next home, identifying key features that enhance comfort and add value is essential. Here are the top features to look for to ensure a smart investment. Conclusion: Identifying must-have features in your next home ensures comfort, convenience, and a smart investment. Prioritize these elements to find a home that meets your needs and offers long-term value.