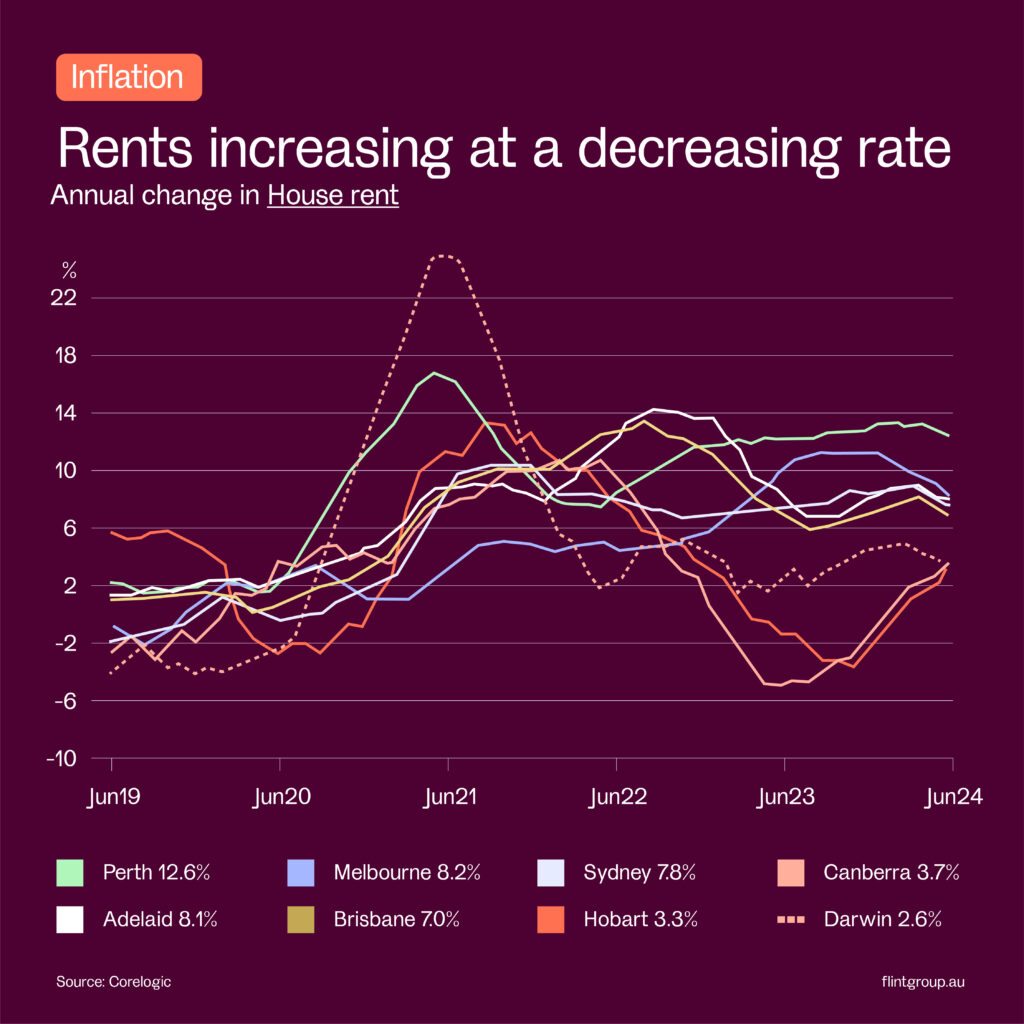

Rents Increasing at a Decreasing Rate: CoreLogic Reports Slowest Growth Since 2020

Reading Time: 4 minutesProperty investors have continued to see gains in rental income, but the pace of these gains is starting to slow, according to the latest data from CoreLogic. In July, the national median rent increased by just 0.1%, marking the smallest monthly rise since August 2020. This deceleration in rental growth is being observed across both the house and unit markets. However, the slowdown is particularly significant in the unit market, which has been a focal point for investors in recent years. CoreLogic’s research director, Tim Lawless, has pointed out that this easing in rental growth aligns with a peak in net overseas migration during the first quarter of 2023. The large majority of these overseas migrants, mostly students, arrive in Australia on temporary visas, which typically drives demand for inner-city unit rentals. “The slowdown in rental growth suggests that some of the pressure on the rental market is easing, particularly in areas that are traditionally popular with overseas students,” said Lawless. “While rents are still rising, the pace of growth has clearly tempered, which could signal a shift in market dynamics moving forward.” Despite this slowdown, the rental market remains tight, and investors are still in a favorable position, especially those who have invested in properties that cater to the specific demands of the rental market. However, as rental growth continues to moderate, it’s essential for investors to stay informed and adapt to the changing market conditions. The combination of rising property prices, increasing rents, and low vacancy rates has kept the rental market competitive, but the recent trends indicate that the rate of rental increases may not be as aggressive as it has been in the past. This could provide some relief to renters, while still offering steady returns for investors. As we move through the second half of the year, it will be interesting to see how these trends develop and what they mean for the broader real estate market in Australia. Conclusion: While the rental market continues to offer opportunities for growth, the recent data from CoreLogic suggests that the rate of this growth is beginning to slow. Investors and renters alike will need to keep a close eye on these trends to make informed decisions in the coming months.

Homebuilding Approval Numbers Falling: A Growing Concern for Australia’s Housing Supply

Reading Time: 4 minutesAustralia is facing a significant challenge in meeting the demand for housing. Despite widespread acknowledgment of the need to increase housing supply, the latest data suggests that the problem might worsen before it improves. Decline in Approvals According to the Australian Bureau of Statistics, the number of dwellings approved for construction in June 2024 was 3.7% lower than in June 2023. This year-over-year decline is concerning, but the issue becomes more alarming when viewed over a longer period. Long-Term Trends Over the five years to June 2019, a total of 1,113,321 homebuilding approvals were issued. However, in the five years to June 2024, this number fell to 935,588 – a 16.0% reduction. This significant drop in approvals is particularly troubling given that the national population increased by approximately 2 million people during the same period. Implications of the Decline The reduction in homebuilding approvals is likely to exacerbate the existing housing shortage. With fewer homes being built, the mismatch between supply and demand will continue to drive up property prices and rents, making housing less affordable for many Australians. Population Growth vs. Housing Supply Australia’s population growth is outpacing the rate of homebuilding approvals. This imbalance is a major factor contributing to the housing crisis. As the population continues to grow, the need for new housing becomes even more critical. Without a substantial increase in homebuilding approvals, the housing shortage will persist and potentially worsen. Government and Industry Response Addressing this issue requires coordinated efforts from both the government and the construction industry. Policies and incentives to boost homebuilding approvals are essential to meet the growing demand for housing. Additionally, addressing barriers to construction, such as land availability and regulatory constraints, will be crucial in increasing the housing supply. Conclusion The decline in homebuilding approvals in Australia is a pressing concern that needs immediate attention. As the population continues to grow, the gap between housing supply and demand will widen unless significant measures are taken to boost homebuilding activities. The future of Australia’s housing market depends on effective and timely responses to this growing issue.

Inflation Holds the Key to Interest Rates Outlook: RBA’s Latest Decision

Reading Time: 5 minutesThe Reserve Bank of Australia (RBA) has announced its decision to maintain the cash rate at 4.35%. This decision is pivotal in understanding the RBA’s approach to managing the Australian economy, especially in light of persistent inflation. Here are the five key takeaways from the RBA’s statement explaining their decision: 1. Inflation Remains a Concern The RBA is notably concerned that inflation, currently at 3.8%, remains above its target range of 2-3%. This elevated inflation rate poses a significant challenge for the central bank, as it aims to stabilise the economy while managing price increases. 2. Priority on Returning Inflation to Target Returning inflation to the target range within a reasonable timeframe is the RBA’s highest priority. The central bank is committed to ensuring that inflation is brought down to manageable levels, which is crucial for economic stability and consumer confidence. 3. Commitment to Necessary Measures The RBA’s statement highlighted its commitment to do whatever is necessary to achieve the desired inflation outcome. This commitment could mean maintaining higher interest rates for an extended period or even increasing the cash rate further if inflation does not decrease as expected. 4. Inflation Forecasts The RBA has forecasted that inflation will return to the 2-3% target range by late 2025. This projection provides a timeline for businesses and consumers to anticipate potential changes in monetary policy and economic conditions. 5. Economic Uncertainty Despite the forecasts, the RBA acknowledges that the economic outlook remains uncertain. There is a possibility that inflation could rise again, depending on various domestic and global economic factors. This uncertainty requires a cautious and flexible approach from the central bank in its monetary policy decisions. Implications for Consumers and Businesses For consumers, the RBA’s decision means that borrowing costs will remain relatively high for the foreseeable future. This could impact spending and saving decisions, especially in areas like housing and personal loans. Businesses will also need to navigate the high-interest-rate environment, which could affect investment and expansion plans. The ongoing focus on controlling inflation might lead to cautious consumer spending, influencing business strategies and market dynamics. Conclusion The RBA’s decision to keep the cash rate at 4.35% underscores the central bank’s commitment to controlling inflation and ensuring long-term economic stability. While the path to achieving the inflation target is clear, the journey is fraught with uncertainties. Both consumers and businesses will need to stay informed and adaptable to the evolving economic landscape.

South Australia Reigns Supreme in CommSec’s State of the States Ranking

Reading Time: 6 minutesFor the third consecutive quarter, South Australia has topped CommSec’s quarterly State of the States ranking, demonstrating remarkable economic resilience and growth. CommSec’s ranking system evaluates the economic performance of Australia’s states and territories by comparing their current standings on eight key economic indicators with their long-term averages. These indicators include unemployment, home building starts, construction work, home lending, population growth, economic growth, retail spending, and equipment investment. South Australia: Leading the Pack South Australia scored the highest in three of the eight indicators, which propelled it to the top spot: 1. Unemployment: South Australia has maintained a strong employment rate, reflecting a robust job market and effective economic policies aimed at reducing unemployment. 2. Home Building Starts: The state has seen a surge in home building starts, indicating a thriving construction sector and a strong demand for new housing. 3. Construction Work: Construction work in South Australia has been at its peak, further contributing to the state’s economic growth and stability. Western Australia: Strong Contender Western Australia ranked second, excelling in two critical indicators: 1. Home Lending: The state leads in home lending, suggesting a high level of confidence among homebuyers and investors in the property market. 2. Population Growth: Western Australia has experienced significant population growth, which supports its economic momentum and future prospects. The ACT: A Balanced Performer The Australian Capital Territory (ACT) secured the fourth position by leading in the remaining three indicators: 1. Economic Growth: The ACT shows strong economic growth, indicating a healthy and expanding economy. 2. Retail Spending: Retail spending in the ACT is robust, reflecting consumer confidence and a vibrant retail sector. 3. Equipment Investment: High levels of equipment investment highlight the ACT’s commitment to infrastructure development and technological advancement. CommSec’s Analysis CommSec senior economist Ryan Felsman noted the overall positive economic performance across Australia’s states and territories. “Across the country, the economic performance of Australia’s states and territories is being supported by both strong employment and population growth, at a time of higher-than-desired price inflation,” Felsman said. While South Australia retains the top position, Western Australia is showing the strongest annual economic momentum. “It will be interesting to see how this plays out in the coming quarters,” Felsman added. Implications for the Future The rankings underscore the dynamic and competitive nature of Australia’s regional economies. South Australia’s consistent performance highlights its economic strength and resilience, while Western Australia’s momentum suggests potential future shifts in the rankings. For policymakers and business leaders, these insights offer valuable guidance for strategic planning and investment decisions. Understanding the key drivers of economic performance can help in crafting policies that promote sustainable growth and development. Conclusion South Australia’s top ranking in CommSec’s State of the States for the third consecutive quarter is a testament to its robust economic performance. With strong showings in unemployment, home building starts, and construction work, South Australia continues to lead the nation. Meanwhile, Western Australia’s significant gains in home lending and population growth signal a state on the rise. As we look ahead, the competition among Australia’s states and territories will likely intensify, driven by ongoing efforts to boost employment, investment, and overall economic health.

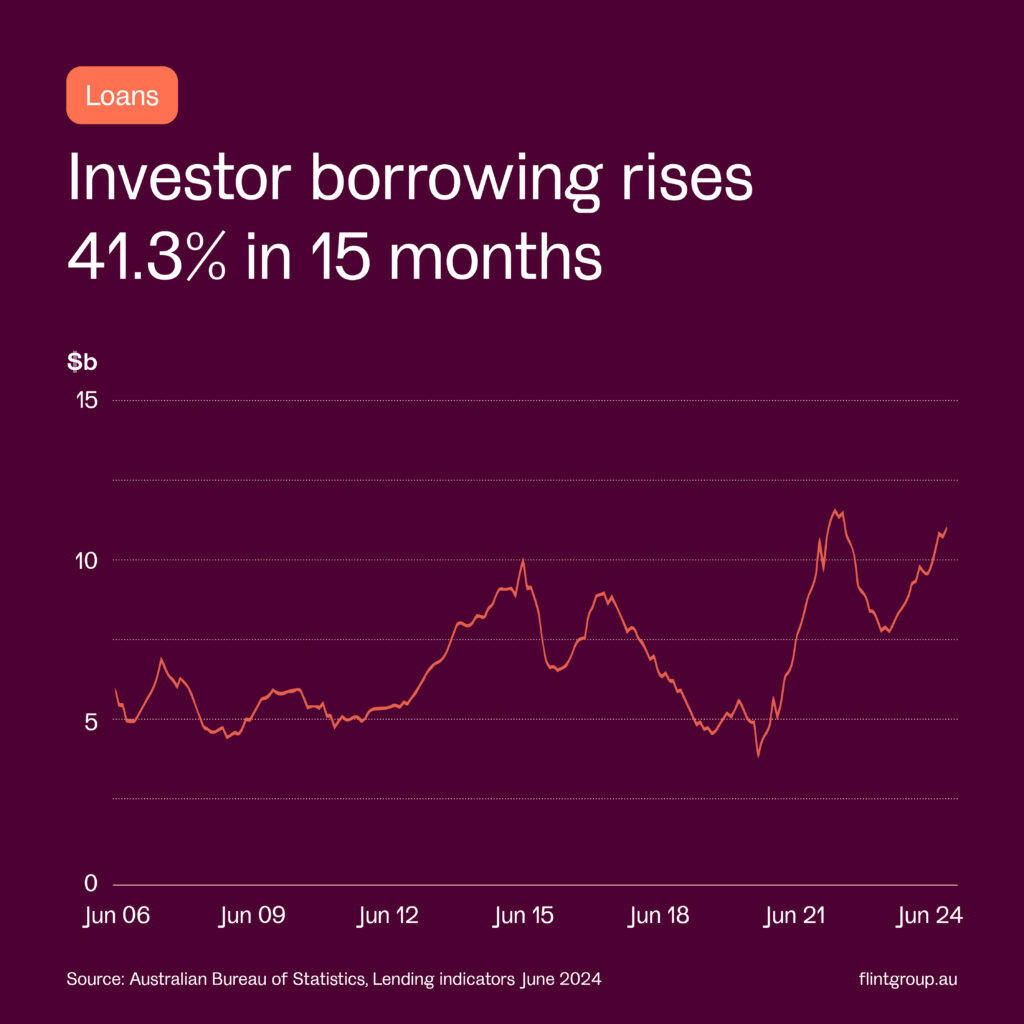

Investor Borrowing Rises 41.3% in 15 Months: What’s Driving the Surge?

Reading Time: 6 minutesThere’s been an astonishing increase in property investor activity over the past 15 months, with no signs of it slowing anytime soon. According to the Australian Bureau of Statistics, investor borrowing has surged 41.3% since March 2023, when investor activity hit its lowest point. In March 2023, investors signed up for $7.797 billion of home loans. Fast forward to June, the most recent month for which we have data, and $11.016 billion of investor loans were issued. This significant rise underscores a growing confidence among property investors, driven by a combination of factors. Factors Driving the Increase in Investor Borrowing Several key reasons contribute to the heightened investor activity in the property market: 1. Rising Property Prices: Property prices have been on an upward trajectory, making real estate an attractive investment option. Investors are keen to capitalise on the potential for capital growth as prices continue to climb. 2. Increasing Rents: Rising rental prices provide a compelling reason for investors to enter the market. Higher rental yields enhance the appeal of property investments, offering better returns compared to other asset classes. 3. Low Vacancy Rates: Vacancy rates remain critically low, ensuring that rental properties are in high demand. This low vacancy environment guarantees steady rental income for property investors, further incentivizing them to invest. 4. Peak Interest Rates: There is a perception that interest rates may have peaked, making borrowing more favorable for investors. The potential for stable or even lower interest rates in the future adds to the attractiveness of taking out property loans now. Comparison with Owner-Occupier Borrowing While investor borrowing has surged significantly, owner-occupier borrowing has also increased during the past 15 months, though at a more modest rate of 15.7%. This difference highlights the distinct motivations and dynamics at play between property investors and owner-occupiers. Implications for the Property Market The substantial increase in investor borrowing is likely to have several implications for the property market: The 41.3% increase in investor borrowing over the past 15 months reflects a buoyant property market driven by rising prices, increasing rents, low vacancy rates, and favorable borrowing conditions. As investor activity continues to surge, the property market is likely to remain dynamic and competitive. For those considering entering the property investment market, it’s essential to stay informed about market trends and economic indicators. Whether you are a seasoned investor or a first-time buyer, understanding the factors driving these changes can help you make informed decisions and capitalise on opportunities in the ever-evolving real estate landscape.

Australia’s Property Prices Continue to Rise: 18 Consecutive Months of Growth

Reading Time: 5 minutesAustralia’s median property price has now increased for 18 consecutive months, after rising another 0.5% in July, according to CoreLogic. This sustained growth has seen the national median price increase by a remarkable 13.5% over this period, achieving new record highs since November 2023. The consistent upward trend in property prices underscores the robust demand and limited supply in the Australian real estate market. However, CoreLogic’s recent analysis indicates that there might be some cooling off in the market dynamics. CoreLogic reports that “the underlying mismatch between housing supply and demand looks set to support housing prices through the second half of the year. However, there does seem to be some rebalancing underway.” This statement points to a potential shift as the market adjusts to new conditions. One of the factors contributing to this shift is the rate at which real estate listings have been appearing on the market. CoreLogic notes that “real estate listings have been flowing onto the market at a pace slightly above average through autumn and winter, which has been testing the depth of buyer demand.” This increase in listings suggests that while demand remains strong, the market is experiencing a slight rebalancing as more properties become available. The Current State of the Market The 18-month streak of rising property prices reflects a broader trend of sustained demand amidst limited housing supply. This trend has been driven by various factors, including historically low interest rates, increased buyer confidence, and a strong economic recovery post-pandemic. The persistent demand has kept prices on an upward trajectory, even as the market faces new listings and potential rebalancing. What Does the Future Hold? While CoreLogic anticipates continued support for housing prices due to the supply-demand mismatch, the potential rebalancing could lead to a more stabilized market in the coming months. The ongoing flow of new listings may provide some relief to buyers who have been facing intense competition and escalating prices. However, the market’s ability to absorb these new listings without a significant drop in prices will be a key factor to watch. If buyer demand continues to be strong, prices may remain elevated, albeit at a more moderated pace. On the other hand, if the influx of listings outpaces buyer interest, we could see a slowdown in price growth. Conclusion Australia’s property market remains dynamic, with prices continuing to rise amidst evolving conditions. The recent data from CoreLogic highlights both the sustained demand and the potential for market rebalancing. As the second half of the year unfolds, all eyes will be on how the market adjusts to these changes and what it means for buyers and sellers alike. For now, the 18 consecutive months of price increases stand as a testament to the resilience and desirability of Australian real estate. Whether this trend will continue or stabilize remains to be seen, but one thing is certain: the Australian property market is one to watch closely.