Vendor Discounting Increases as Property Market Shows Signs of Cooling

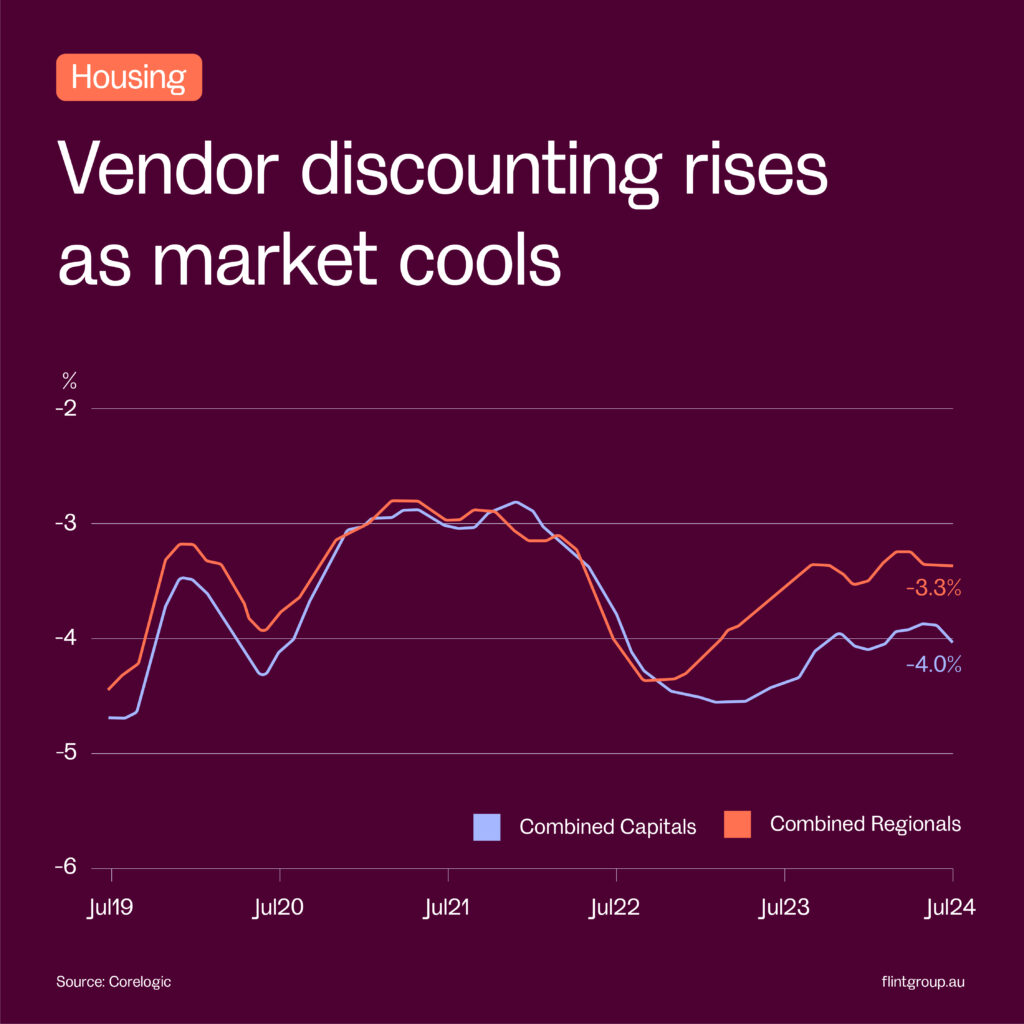

Reading Time: 3 minutesAs the Australian property market shows signs of cooling, there’s been a noticeable rise in vendor discounting, indicating that sellers are finding it harder to secure buyers without negotiating on price. According to CoreLogic’s latest data, vendors across the country had to offer a median discount of 3.7% during the July quarter to achieve a sale, a slight increase from the 3.6% discount recorded in June. This increase in discounting reflects the current slowdown in capital gains, with vendors needing to be more flexible in their pricing to attract buyers as market conditions shift. CoreLogic noted, “The recent increase mirrors the current slowdown in the pace of capital gains, suggesting vendors are now having to negotiate a little more to secure a sale as heat leaves the market.” The extent of discounting varies between regions, with capital city vendors offering a median discount of 3.3%, while regional vendors had to offer a larger discount of 4.0%. This pattern aligns with the general trend that hotter markets, where demand outstrips supply, typically see less discounting, while cooler markets require more negotiation. In terms of individual capital cities, the median vendor discounts during the July quarter were as follows: These figures highlight the varying degrees of market cooling across different regions. For instance, Perth and Brisbane, which have been experiencing stronger market conditions, saw lower levels of discounting compared to cities like Darwin and Hobart, where the market is relatively cooler. As we move further into the year, it will be interesting to see how these trends evolve, particularly as economic conditions and buyer sentiment continue to fluctuate.

Australian Property Market Yields Record Profits in 2023-24

Reading Time: 3 minutesThe Australian property market has delivered its best profit results in over a decade, with an overwhelming majority of vendors enjoying substantial returns on their property sales during the 2023-24 financial year. According to research from Domain, 96.0% of house vendors and 90.7% of unit vendors across the nation achieved a gross profit, marking the highest percentages since 2008 for houses and 2011 for units. This surge in profitability is largely attributed to the ongoing rise in property prices across the country. Domain’s chief of research & economics, Nicola Powell, highlighted the correlation between rising prices and the likelihood of making a profit, stating, “As Australia grapples with record pricing, it is unsurprising that the pool of profit-making sales has risen, as the likelihood of profitability increases as prices rise.” Interestingly, the data reveals that a slightly higher percentage of regional vendors made profits compared to those in capital cities. Specifically, 96.1% of house vendors and 94.6% of unit vendors in regional areas achieved profits, compared to 96.0% and 89.4% in capital cities, respectively. This trend underscores the strong demand for regional properties, which has been a prominent feature of the market in recent years. These remarkable profit figures demonstrate the enduring value of Australian real estate. For those able to enter the market, the potential for significant financial gains remains strong, even amidst broader economic challenges. As we move further into 2024, the property market continues to show resilience, offering promising opportunities for both current homeowners and potential buyers looking to invest in the future.

How Long Are Properties Taking to Sell? A Snapshot of Australia’s Property Market

Reading Time: 5 minutesThe time it takes to sell a property is a key indicator of the health of the real estate market. According to the latest data from CoreLogic, properties listed for sale across Australia during the July quarter took a median of 33 days to sell. This figure varies significantly depending on the location, with properties in the combined capitals selling faster (28 days) compared to those in the combined regions (44 days). Days on Market: A Measure of Market Strength Days on market (DOM) is an essential metric in real estate, reflecting the level of buyer competition and the pace of price growth. Generally, the fewer days a property spends on the market, the more competitive the market is, and the stronger the upward pressure on prices. Fastest-Selling Markets The Perth property market is currently experiencing a boom, which is evident in the astonishingly low median DOM of just 10 days. This rapid turnaround time indicates a hot market with strong buyer demand and quick sales. Brisbane and Adelaide are also enjoying robust property markets, with median DOM of 20 days and 28 days, respectively. These cities have been seeing consistent price growth, further fueled by the competitive buying environment. Slower Markets in Major Cities In contrast, the property markets in Sydney, Melbourne, and Canberra are showing signs of cooling, with properties taking longer to sell. Sydney’s median DOM is 34 days, Melbourne’s is 39 days, and Canberra’s is 49 days. The extended time on market in these cities suggests a more balanced market with less urgency among buyers. Markets Facing Challenges The slowest markets in Australia right now are Darwin and Hobart, where properties are taking the longest to sell. In Darwin, the median DOM is 50.5 days, while in Hobart, it’s 54.5 days. Both cities are currently experiencing price declines, which is likely contributing to the extended selling periods. Conclusion: The number of days a property spends on the market is a telling indicator of the real estate landscape. In cities like Perth, Brisbane, and Adelaide, properties are selling quickly, driven by strong buyer demand and rising prices. Conversely, markets in Sydney, Melbourne, and Canberra are seeing slower sales, reflecting more balanced conditions. Darwin and Hobart, where prices are falling, are facing the longest selling periods. Understanding the dynamics of days on market can provide valuable insights for both buyers and sellers as they navigate the current property market.

Wages Growth Slows for Third Consecutive Quarter: Implications for RBA Decisions

Reading Time: 4 minutesAustralia’s wage growth has continued to decelerate, with the latest data from the Australian Bureau of Statistics revealing a 0.8% increase in the June quarter. This marks the third consecutive quarter of declining wage growth, following increases of 1.3% in the September 2023 quarter, 1.0% in the December quarter, and 0.9% in the March quarter. The Connection Between Wages and Inflation Wages growth is a crucial economic indicator closely monitored by the Reserve Bank of Australia (RBA) as it plays a significant role in inflation dynamics. Lower wages growth generally correlates with lower inflation, which is a critical factor in the RBA’s decisions regarding the cash rate. The RBA’s primary goal is to return inflation to its target range of 2-3%, and wage trends are a key determinant in this effort. In its recent Statement on Monetary Policy, the RBA acknowledged that while wages growth has likely passed its peak, it remains elevated compared to the trend growth rate of productivity. “In Australia, there is still more demand for goods and services than the economy can sustainably supply, causing inflation to be persistent. Conditions in the labour market are easing but still tight, and wages growth remains high even though productivity growth is weak,” the RBA noted. What This Means for Interest Rates As the RBA reviews economic data to determine its next move on the cash rate, the slowing pace of wage growth will likely be a significant consideration. If wages growth continues to decelerate, it could ease inflationary pressures, potentially leading the RBA to lower the cash rate in the future. However, the RBA has also emphasised that wages growth, even at current levels, may still be unsustainable without corresponding productivity gains. This suggests that the RBA might remain cautious in its approach, potentially opting to keep interest rates higher for longer to ensure inflation is firmly under control. Conclusion: The slowdown in wages growth is a double-edged sword for the Australian economy. On one hand, it could help in curbing inflation, bringing it closer to the RBA’s target range. On the other hand, the persistence of high wages growth relative to productivity levels indicates that inflationary pressures may linger, complicating the RBA’s path to lower interest rates. As the RBA continues to navigate these challenges, the interplay between wages, inflation, and interest rates will remain a focal point in the months ahead.

Property Investor Survey: Queensland Leads as Top Investment Destination

Reading Time: 4 minutesProperty investors across Australia are eyeing Queensland as the state with the most promising investment prospects, according to the latest quarterly survey conducted by Australian Property Investor magazine. The survey reveals that 33% of respondents believe Queensland offers the best opportunities for property investment, positioning it ahead of New South Wales and Western Australia. New South Wales, home to Australia’s largest city, Sydney, ranked second, with 26% of investors viewing it as the most favorable investment location. Western Australia followed with 16%, showcasing a diverse range of preferences among property investors. Investor Confidence Remains Strong The survey also provided insights into investor sentiment regarding property prices and the broader market outlook. A significant 70% of respondents expect property prices to rise over the next 12 months, reflecting a strong confidence in the market’s resilience. Meanwhile, 15% of investors predict that prices will remain stable, and another 15% anticipate a decline. This optimistic outlook suggests that despite various economic challenges, including fluctuating interest rates and broader economic uncertainties, many investors still see property as a reliable and profitable investment. Interest Rates: A Factor, but Not a Deal-Breaker Interest rates, a critical factor in property investment decisions, were also examined in the survey. While 35% of respondents acknowledged that rising interest rates are influencing their decision on whether to buy an investment property, only 20% indicated that interest rates would impact their decision to sell. This finding suggests that while higher interest rates may cause some hesitation before entering the market, they are less of a concern for those who are already invested. For current investors, this could indicate a level of comfort and confidence in their existing investments, despite the potential for increased borrowing costs. For prospective buyers, the data shows that while interest rates are a consideration, they are not necessarily a deterrent. Conclusion: The results of this survey highlight Queensland’s appeal as a leading destination for property investment, driven by investor confidence in the state’s growth prospects. Additionally, while interest rates play a role in investment decisions, they are not the dominant factor for most investors. As the property market continues to evolve, Queensland, New South Wales, and Western Australia remain key areas to watch for both seasoned and new investors alike.

New Listings Rise 1.0% in June: A Positive Shift for Property Buyers

Reading Time: 4 minutesThe balance of power in Australia’s property market may be tilting in favor of buyers, as new property listings have started to increase across many parts of the country. According to the latest data from SQM Research, 65,863 new properties were listed for sale in June, marking a 1.0% rise from the previous month and a 3.7% increase compared to the same time last year. This uptick in new listings is particularly significant as it suggests that more properties are entering the market, giving buyers a broader range of options to choose from. Four of Australia’s capital cities reported month-on-month increases in new listings, while five cities saw year-on-year increases. For buyers, this is welcome news. An increase in available properties typically translates to less competition, which can improve their negotiating power when dealing with vendors. More options mean buyers can be more selective, and in many cases, may be able to secure a property at a more favorable price. In recent months, the property market has been characterised by low stock levels and intense competition among buyers, often leading to price increases and bidding wars. However, with more properties coming onto the market, there’s a growing indication that the market is beginning to rebalance, which could bring some relief to buyers who have been feeling the pressure. This trend also reflects a broader shift in market dynamics, as some sellers who may have been waiting on the sidelines are now deciding to list their properties. Whether due to perceived market peaks or other personal factors, this influx of new listings could signal a more active and balanced market in the coming months. For sellers, while the increase in competition might mean adjusting expectations, it could also lead to quicker sales if they price their properties competitively. The overall market activity suggests a healthy level of engagement, with both buyers and sellers finding opportunities to achieve their real estate goals. Conclusion: As we move further into the year, the increase in new property listings is a positive development for buyers looking for more options and better negotiating power. This shift could also indicate a more balanced market on the horizon, benefiting both buyers and sellers alike.