Homebuilding Approvals on the Rise but Still Below Average

Reading Time: 3 minutesThe Australian housing market is showing signs of life, with homebuilding approvals increasing for the fifth time in six months. This trend provides a glimmer of hope for the nation’s housing supply, which has been struggling to keep up with demand. According to the latest data from the Australian Bureau of Statistics, the number of homebuilding approvals has risen from a recent low of 12,877 in January to 14,797 in July, marking a significant 14.9% increase over this period. A closer look at the data reveals that approvals for houses saw a robust increase of 20.2%, while approvals for other dwellings, including apartments, townhouses, and semi-detached homes, grew by 5.5%. However, while these figures are encouraging, it’s important to sound two notes of caution. First, despite the recent upward trend, homebuilding approvals remain below the 10-year average. This suggests that, although there is improvement, the supply of new housing is still not meeting long-term needs. Second, it’s crucial to remember that approvals don’t automatically translate into completed projects. A certain percentage of owners and developers may decide not to proceed with their construction plans after receiving approval, which means the actual impact on housing supply could be less than these numbers suggest. The housing market is complex, and while the rise in approvals is a positive development, the broader context indicates that challenges remain. As Australia continues to grapple with a housing shortage, the industry will need to find ways to ensure that approved projects move through to completion, helping to address the ongoing supply-demand imbalance.

National Median Property Price Climbs for 19th Straight Month

Reading Time: 3 minutesAustralia’s property market continues its upward trajectory, with the national median property price increasing for the 19th consecutive month in August. However, the rate of growth is beginning to decelerate, raising questions about the sustainability of this trend. According to CoreLogic, the national median price rose by 0.5% in August, but the pace of growth has noticeably slowed. CoreLogic attributes this slowdown to affordability constraints, which have become a significant factor in the market.”Affordability constraints are a key factor behind the broader slowdown,” CoreLogic reported, highlighting the challenges faced by buyers in an environment of rising property prices and high living costs.The delicate balance between supply and demand also plays a critical role in the market’s current dynamics. While there remains more demand for housing than available supply, CoreLogic noted that the flow of advertised supply and demand is becoming increasingly balanced.Despite these headwinds, CoreLogic forecasts that the national median price will continue to rise through the remaining months of 2024, though at a more modest pace. This continued growth is underpinned by a longer-term shortage of new housing supply, a problem that has been exacerbated by ongoing constraints in the residential construction sector.Buyer activity has slowed amid high cost-of-living pressures, but CoreLogic suggests that many vendors still hold the upper hand. In most markets, sellers may choose to delay their property sales if buyers do not meet their price expectations, potentially keeping prices elevated.As the market evolves, both buyers and sellers will need to navigate these challenging conditions carefully. While growth is slowing, the underlying fundamentals of supply and demand continue to support a positive outlook for property prices, albeit at a more restrained pace.

Regional Property Markets Cool as Internal Migration Slows

Reading Time: 4 minutesEarlier this year, regional property markets were outperforming their capital city counterparts, fueled by strong demand and a migration boom. However, the tide has turned, with regional markets now showing signs of slowing down, while capital cities are regaining momentum. According to the latest data from CoreLogic, the combined regions saw a median price increase of just 1.3% in the July quarter, compared to a stronger 1.8% rise in the combined capitals. This marks a notable shift from the April quarter, when regional markets enjoyed a 2.2% price increase, outpacing the 2.0% growth seen in capital cities. Several factors are contributing to this change. Affordability constraints, normalizing listing levels, and elevated interest rates have all played a role in tempering the pace of growth across both regional and urban markets. However, a significant driver of the slowdown in regional areas has been the reduction in internal migration. During the pandemic, many Australians flocked to regional areas in search of more space and a better quality of life, driving up demand and prices. But as the country returns to a more normal state, internal migration to the regions has slowed, reducing the upward pressure on property prices. The impact of this shift is evident in the fact that 20 of the 50 largest regional markets experienced price declines during the July quarter. Notably, all these declines occurred in New South Wales and Victoria, two states that had previously seen significant migration-driven growth. In contrast, Queensland continues to lead the regional market in terms of price growth, followed closely by Western Australia. These states are benefiting from a combination of factors, including continued population growth, relatively affordable property prices, and strong economic conditions. As the property market evolves, both buyers and investors will need to stay attuned to these shifting dynamics. While regional areas may no longer offer the same level of growth as they did during the height of the pandemic, certain regions still present opportunities for those who are strategic in their property choices.

Residential Construction Declines 2.9% as Demand Outpaces Supply

Reading Time: < 1 minute

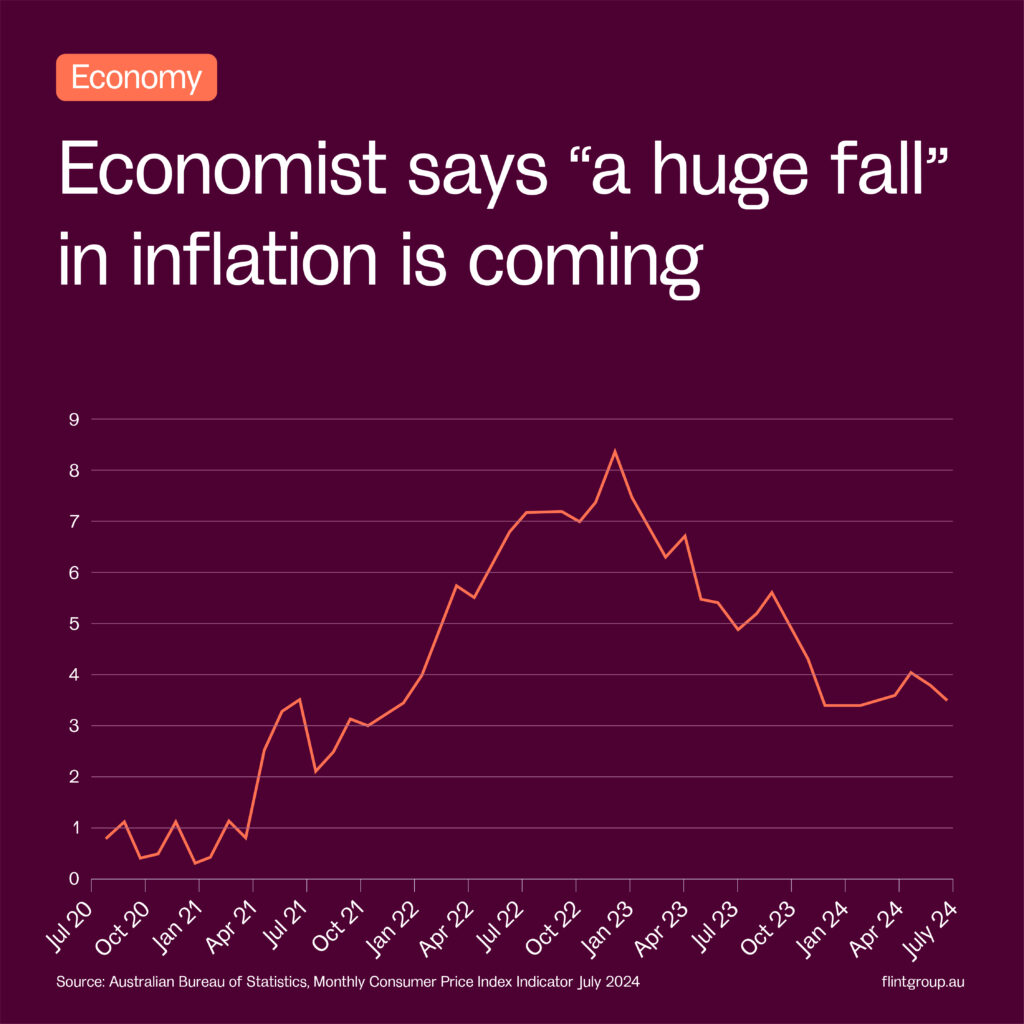

Economist Predicts “Huge Fall” in Inflation, but RBA Rate Cuts Unlikely Until 2025

Reading Time: 3 minutesAustralia’s inflation rate is showing signs of easing, with the annual figure dropping from 3.8% in June to 3.5% in July, according to the latest data from the Australian Bureau of Statistics. This movement brings the country closer to the Reserve Bank of Australia’s (RBA) target inflation range of 2-3%, which has sparked discussions about the possibility of future cash rate reductions. Prominent economist Chris Richardson has forecasted that inflation will experience “a huge fall” in the near future. However, he cautions that this does not necessarily signal an imminent reduction in interest rates. “I don’t think that means the Reserve Bank is about to cut rates,” Richardson noted, suggesting that the first half of 2025 is the most likely period for the beginning of the rate-cutting cycle. Despite a range of subsidies introduced by federal and state governments aimed at reducing household costs, Richardson believes these measures will not be the primary drivers behind the anticipated drop in inflation. “The reduction in inflation would happen despite these subsidies rather than because of them,” he explained. According to Richardson, the expected decrease in inflation is more likely due to the prolonged period of higher interest rates both in Australia and globally. “Rates will eventually fall because they’ve been higher here and around the world for some time, and that medicine is working. Add in a dash of slowdown in China, and the global fight against inflation is gradually being won.” While this outlook may offer some optimism for the future, it also suggests that consumers and businesses should not expect immediate relief from the current interest rate environment. The RBA’s cautious approach indicates that while inflation is on a downward trajectory, the timeline for rate cuts may extend further than many had hoped.

US-Based Buyer Interest in Australian Real Estate Jumps 51.2%

Reading Time: 3 minutesInterest in Australian real estate from US-based buyers has surged significantly, with search activity increasing by 51.2% in July compared to the previous year, according to a recent analysis by PropTrack. This spike has catapulted the United States to the top position as the leading source of overseas buyer interest in Australian property. The dramatic rise in searches may be linked to the upcoming presidential election, which often stirs economic and political uncertainty, prompting potential buyers to explore international property options. This trend mirrors past patterns where overseas searches spiked during periods of turmoil. For example, there was a noticeable increase in searches from Hong Kong during the 2019 unrest and at the start of the COVID-19 pandemic. Senior data analyst Karen Dellow explained, “It is common to see a spike in searches from overseas when there is political or economic turmoil in other countries, and an increase in searches from Hong Kong began during the unrest in 2019 and searches also rose at the start of the pandemic.” While it’s challenging to determine whether these searchers are Australian expatriates or foreign nationals, Dellow noted that it is more likely that Australians living abroad make up the majority, especially during times of global events that could impact their standard of living. Following the US, New Zealand ranked second in overseas buyer interest in July, with a 9.5% increase in search activity compared to the previous year. Other countries showing heightened interest included the UK (up 15.7%), Singapore (up 19.9%), and India (up 21.8%). Conversely, interest from Hong Kong and China decreased by 2.0% and 15.1%, respectively. This data suggests that Australia remains an attractive destination for property investment, particularly during times of uncertainty in other parts of the world.