First home buyer scheme delivering results

Reading Time: 2 minutesThe federal government’s Home Guarantee Scheme (HGS) is proving to be a significant boost for first home buyers. According to a new report from Housing Australia, around one in three first home buyers who entered the market during the 2023-24 financial year used the scheme to secure their home. The HGS allows eligible first-time buyers, as well as those who haven’t owned property in the last 10 years, to purchase with just a 5% deposit while avoiding the added cost of lender’s mortgage insurance. This opportunity is available only for owner-occupiers and is open to individuals earning less than $125,000 annually or couples with a combined income under $200,000. Additional eligibility criteria also apply. The report highlighted some key figures for participants in the scheme. In capital cities, the median income for single buyers was $85,000, while joint buyers earned $134,000. Their median property purchase prices were $482,000 and $624,000, respectively. For those in regional areas, single buyers had a median income of $78,000 and couples $126,000, with property prices of $390,000 for singles and $520,000 for couples. This initiative has opened doors for many Australians, helping them achieve their homeownership dreams even amidst rising property prices.

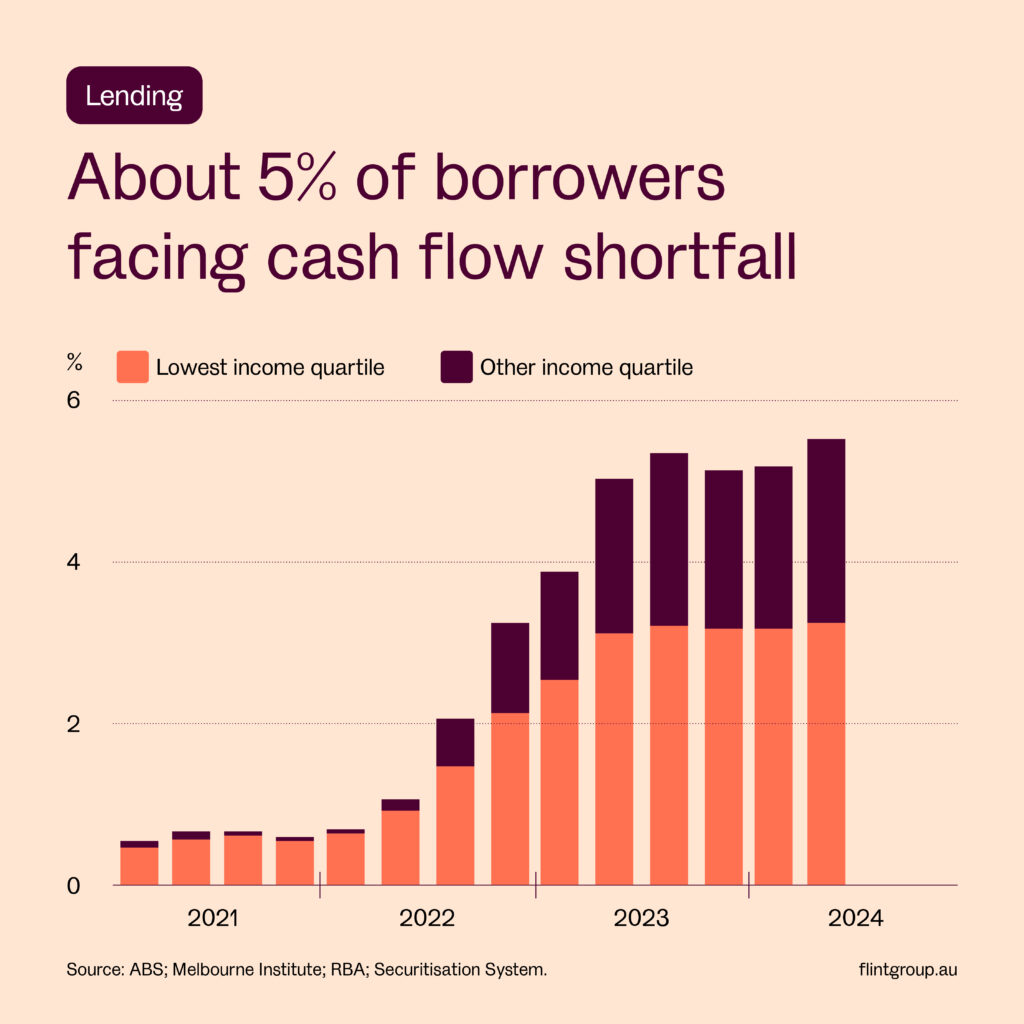

5% of Borrowers Facing Cash Flow Shortfall Amid Rising Interest Rates

Reading Time: 3 minutesRising interest rates have led to financial strain for a subset of Australian mortgage borrowers, with about 5% facing a cash flow shortfall, according to Reserve Bank of Australia (RBA) Governor Michele Bullock. While higher rates have been deemed essential to curbing inflation, they have also put pressure on households with variable-rate loans. Governor Bullock acknowledged that higher interest rates are a necessary evil in the battle against inflation. “Inflation causes hardship, particularly for the more vulnerable in our community,” she said. However, she also admitted that these higher rates have left some mortgage holders in a vulnerable position, with many “feeling the squeeze” as the cost of borrowing continues to rise. For a small but significant group of borrowers, their situation is particularly challenging. Bullock revealed that approximately 5% of owner-occupiers with variable-rate loans are in a precarious position, where their essential spending combined with mortgage repayments exceeds their income, leaving them with a cash flow shortfall. “Although this group is fairly small overall, those in it have had to make quite painful adjustments to avoid falling behind on their mortgage repayments,” Governor Bullock said. These adjustments include cutting back on non-essential spending, opting for lower-quality goods and services, dipping into savings, or working extra hours. The financial stress affecting these borrowers highlights the impact of the RBA’s monetary policy on household budgets. While the goal of reducing inflation remains a priority, the road ahead may continue to be difficult for some mortgage holders.

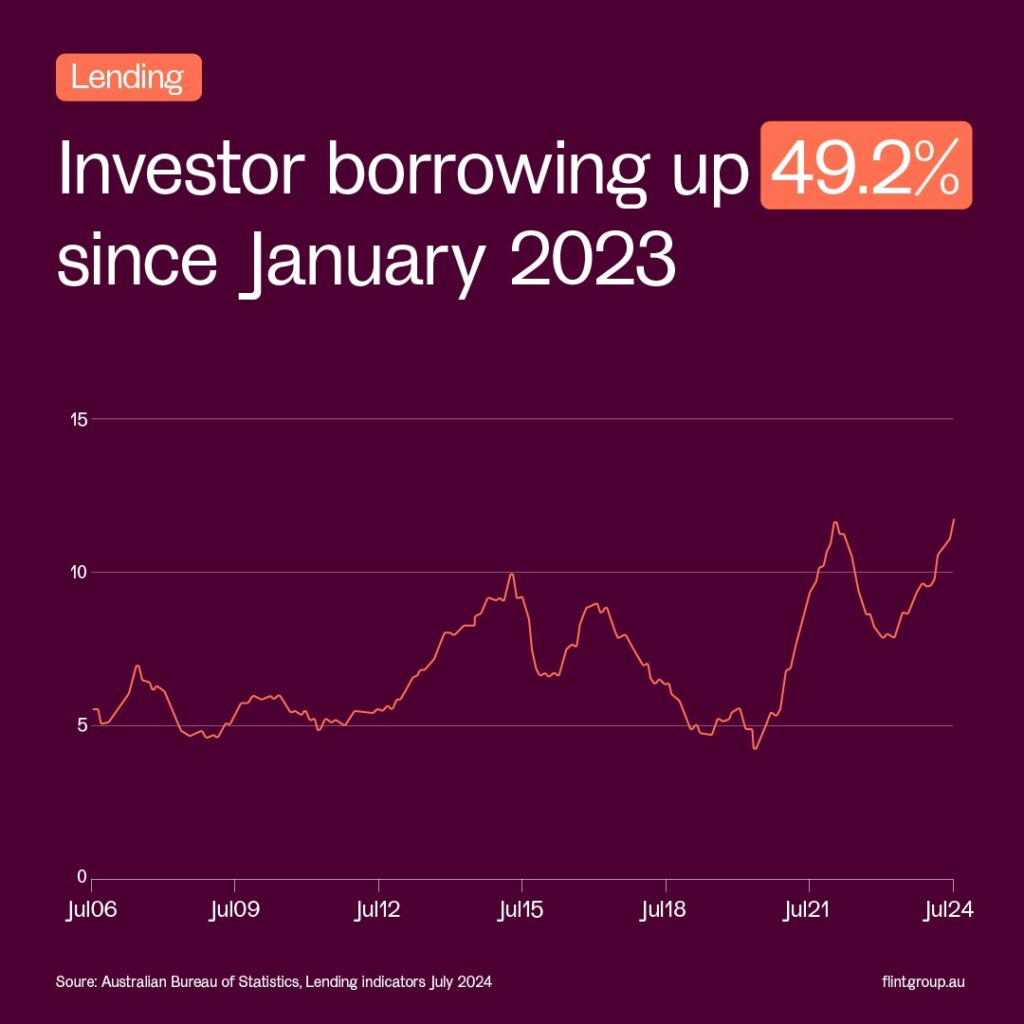

Property Investor Borrowing Surges 49.2% Since January 2023

Reading Time: 3 minutesInvestor borrowing in Australia’s property market is on the rise, nearing record levels and showing a strong resurgence. According to the latest data from the Australian Bureau of Statistics, property investors signed up for $11.708 billion worth of home loans in July 2024, marking a significant 49.2% increase since January 2023. This upward trend follows a steady decline that began after investor borrowing hit an all-time high of $11.762 billion in January 2022, only to bottom out at $7.849 billion in January 2023. The strong resurgence in investor borrowing over the past 18 months suggests renewed confidence in the market as investors seek to capitalise on rising property prices and rents. Comparatively, borrowing by owner-occupiers has risen by 22.5% over the same period. While still strong, it is clear that investors are driving much of the activity in the market. What is fuelling this investor activity? Several factors seem to be at play, including rising property values, increasing rental income, and widespread speculation that interest rates may fall in early 2025. With the potential for declining rates, investors may see this as a prime opportunity to secure property at current price levels before borrowing costs decrease further. As the property market continues to evolve, all eyes will be on how investor borrowing trends impact market dynamics in the months ahead.

Lender’s Mortgage Insurance (LMI) Explained: A Comprehensive Guide for Homebuyers

Reading Time: 8 minutesBuying a home is one of the most significant financial decisions you’ll ever make, and for many Australians, securing a home loan can feel daunting—especially if you don’t have a 20% deposit. This is where Lender’s Mortgage Insurance (LMI) comes into play. LMI is a type of insurance designed to protect the lender if the borrower is unable to meet their home loan repayments. It allows buyers, particularly first-time homebuyers, to enter the property market with a smaller deposit. In this guide, we will explain what LMI is, how it works, and how it can impact your home loan journey. What is Lender’s Mortgage Insurance (LMI)? Lender’s Mortgage Insurance (LMI) is an insurance policy that protects the lender, not the borrower, in case the borrower defaults on their home loan. It is typically required when the borrower is unable to provide a deposit of at least 20% of the property’s purchase price. In simple terms, LMI reduces the financial risk for lenders, making it possible for them to offer loans to borrowers with smaller deposits. While this can be an invaluable tool for many, it’s important to understand that the cost of LMI is borne by the borrower. Why Do Lenders Require LMI? Lenders consider loans with lower deposits (less than 20%) to be riskier. If a borrower defaults on their loan and the sale of the property doesn’t cover the outstanding loan amount, the lender can suffer a financial loss. LMI is designed to mitigate this risk by covering any shortfall in such situations. For borrowers, the benefit of paying LMI is that it allows them to secure a loan with a lower deposit, which could help them enter the property market sooner. Without LMI, many first-time homebuyers would have to wait years to save up a 20% deposit. How Much Does LMI Cost? The cost of LMI depends on several factors, including the size of the deposit, the loan amount, and the lender’s specific policies. As a general rule, the smaller your deposit, the higher the LMI premium. For example: In most cases, the LMI premium is a one-time fee, though it can often be added to your home loan and paid off over time. Is LMI Refundable? If you pay off your loan early or refinance within the first two years, some lenders may offer a partial refund of your LMI premium. However, this is not common practice, so it’s worth asking your lender about their specific LMI policies. How Can You Avoid Paying LMI? While LMI can help homebuyers with lower deposits, there are ways to avoid it altogether: How Does LMI Affect Your Loan? LMI directly affects your loan costs by adding an additional upfront cost or increasing your monthly repayments if the LMI premium is added to the loan amount. Although LMI can make it easier to get a loan with a lower deposit, it’s crucial to factor this into your long-term financial planning. The added cost of LMI can increase your overall borrowing amount and the total interest paid over the life of your loan. LMI and First-Time Homebuyers For first-time buyers, LMI can be a useful tool to enter the property market sooner rather than later. Rather than waiting several years to save a 20% deposit, LMI allows buyers to purchase a home with as little as 5% saved. However, it’s essential to weigh the pros and cons, ensuring that the added cost of LMI is manageable within your budget. Conclusion Lender’s Mortgage Insurance (LMI) is an important part of the home loan process, especially for buyers with smaller deposits. While it does add to the overall cost of purchasing a home, it can help make homeownership more accessible for many Australians. Before committing to a home loan with LMI, it’s essential to fully understand how it works, what it costs, and whether it’s the right option for you.

Australian Property Listings Surge by 7.9% in August, Changing the Buyer-Seller Dynamic

Reading Time: 3 minutesThe Australian property market is heating up for spring, with a significant increase in the number of properties listed for sale. According to SQM Research, a total of 249,523 properties were listed in August, marking a 7.9% rise from the previous month and an 11.1% increase compared to the same time last year. This surge in new listings will have important implications for both buyers and sellers in the coming months. For buyers, the increased supply means more choices and less competition. With a wider range of properties on the market, buyers will have more time to conduct their due diligence, weigh their options, and negotiate on price. The power dynamic, which often favours sellers in a tight market, is starting to shift towards buyers as they gain more negotiating leverage. On the flip side, sellers will need to adjust their strategies. With more properties on the market, attracting potential buyers will require more effort. Vendors may need to invest in stronger marketing campaigns, stage more attractive open homes, and be more flexible on pricing to capture buyers’ attention. The increase in listings is likely to push sellers to negotiate more, potentially cooling the rapid price growth seen earlier in the year. The spring selling season is set to be a dynamic one, with the current trend of rising listings reshaping the property market for both parties.

Australia’s GDP Growth Slows to 1.5%, Bringing Rate Cut Closer

Reading Time: 3 minutesAustralia’s economy is growing at its slowest pace in over 30 years, outside of the pandemic period, which could pave the way for an interest rate cut in the near future. According to the Australian Bureau of Statistics, the nation’s gross domestic product (GDP) increased by just 0.2% in the June quarter and by 1.5% during the 2023-24 financial year. This rate of growth marks the weakest annual expansion since the 1991-92 financial year, excluding the pandemic years, signaling a marked slowdown in economic activity. Interestingly, while the economy grew, Australia’s population expanded at a faster rate. As a result, GDP per capita actually fell by 1.0% during the last financial year. In simple terms, while the overall pie got 1.5% larger, each person’s slice of that pie got 1.0% smaller. This economic slowdown is not unexpected. The Reserve Bank of Australia (RBA) significantly increased interest rates in 2022 and 2023 to slow down the economy and curb inflation. The latest data confirms that this strategy is working. The economy is weakening, inflation is falling, and unemployment is rising. As inflation continues to decrease, the RBA may feel it is close to achieving its goal of crushing inflationary pressures. Once the RBA believes inflation has been sufficiently subdued, it may consider reducing the cash rate, which could lead to lower mortgage rates. The current economic climate suggests that an interest rate cut could be on the horizon, offering some relief to homeowners and borrowers who have faced rising mortgage costs over the past two years.