Property Prices Rise for 20th Consecutive Month, but Growth is Slowing

Reading Time: 5 minutesAustralia’s national property market is currently sending mixed signals. While the country has seen an impressive run of 20 consecutive months of property price growth, the pace of this growth is showing signs of slowing down. 20th Consecutive Month of Growth According to CoreLogic, Australia’s median property price rose by 0.4% in September 2024, marking the 20th consecutive month of positive price movement. This consistent growth is indicative of the strong demand seen in the housing market, even amidst broader economic uncertainties. However, a closer look at the numbers reveals that while prices are still rising, they are not increasing at the same pace as before. Over the three months to September, the national median property price increased by just 1.0%. This is the smallest quarterly rise since March 2023, back when this current cycle of growth was in its early stages. Supply is Increasing, Slowing Price Growth One of the key reasons for the slowing market is the rise in housing supply. More homes are being listed, making it harder for vendors to secure quick sales at their desired price points. CoreLogic data shows that the number of new property listings in September 2024 was 3.2% higher than at the same time last year. This increase in listings has pushed supply 8.8% higher than the five-year average for this time of year. This influx of new listings means more competition among sellers, which can slow down price growth as buyers have more options. Consequently, homes are sitting on the market for longer periods before being sold. Auction Clearance Rates and Selling Times Decline Auction clearance rates—a strong indicator of market demand—have also been trending downward. Across the combined capital cities, clearance rates dropped to the low 60% range in September, which is about 4 percentage points below the decade average. Similarly, properties sold by private treaty are now taking longer to sell. The median time for a home to be on the market nationally was 32 days in the September quarter, up from 29 days in the June quarter and 27 days in the same period last year. What Does This Mean for Buyers and Sellers? For buyers, this slight slowdown in the market could be a positive signal, as increased supply and longer selling times may translate into more negotiating power. For sellers, however, it could mean having to temper expectations regarding how quickly their property will sell and at what price. The long-term outlook for the market remains uncertain, as it will depend on a variety of factors, including interest rates, the broader economy, and further changes in housing supply. In summary, while the Australian property market has experienced strong growth over the past 20 months, current indicators suggest the market is starting to cool off. Sellers may face more competition, while buyers could find themselves with more opportunities as supply rises.

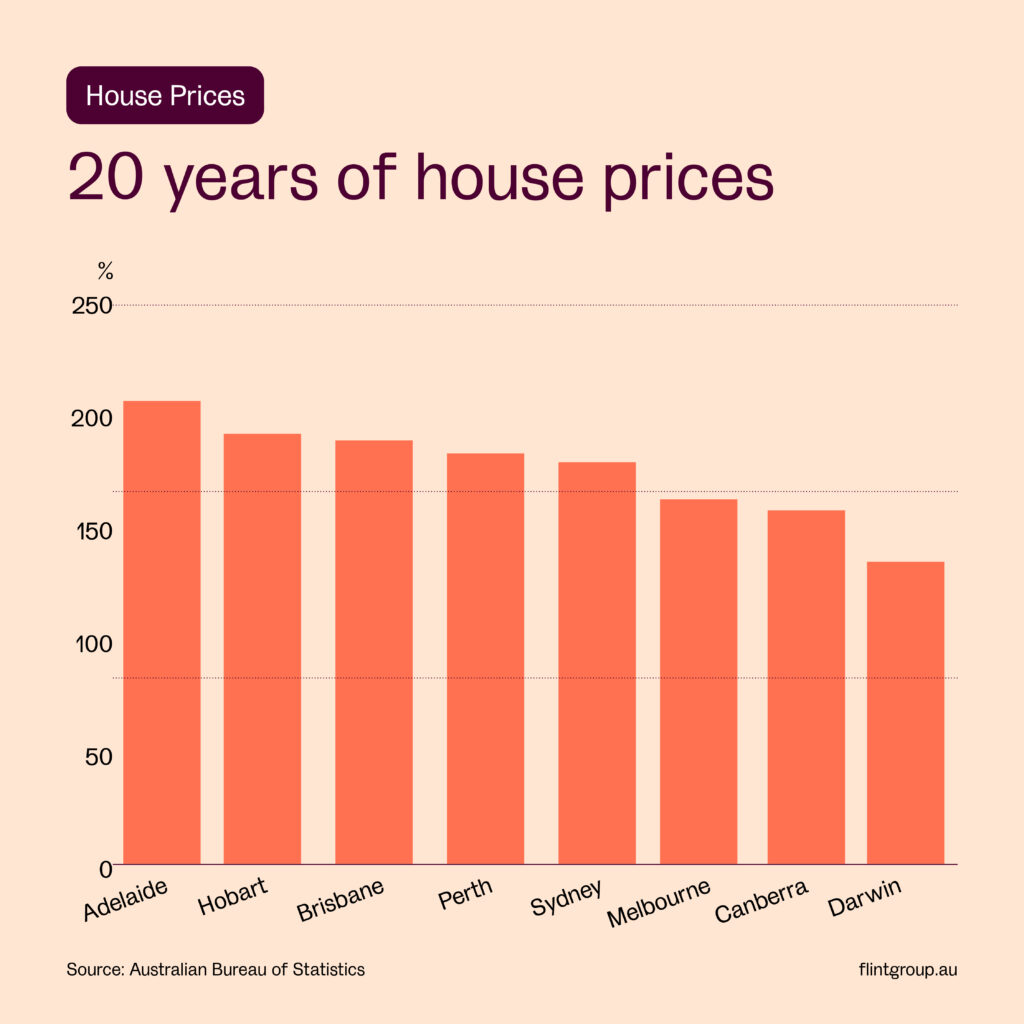

20 Years of House Prices: Adelaide Leads the Way

Reading Time: 2 minutesWhich Australian capital city has seen the strongest house price growth over the past 20 years? According to median house price data from the Australian Bureau of Statistics (ABS), Adelaide takes the top spot, with an impressive 209% growth from June 2004 to June 2024. Here’s how the other capital cities compare: The data demonstrates that regardless of the city, property owners who bought homes two decades ago have seen significant capital appreciation. This explains why property investing remains a favored wealth-building strategy for many Australians. The figures highlight the long-term benefits of homeownership and investing in real estate across the country’s major cities. Whether you’re a seasoned investor or first-time buyer, understanding these trends can help you make informed decisions in today’s property market

Australia Not Building Enough Homes, Says Minister

Reading Time: 3 minutesAustralia is grappling with a housing crisis that has been developing over decades, according to Federal Housing Minister Clare O’Neil. Speaking at the AFR Property Summit, Minister O’Neil explained that the gap between incomes and house prices began widening in the 1980s and has accelerated since the late 1990s. “At the turn of the century, the median household price was about four times the average income. Today, it’s nearly eight times,” she said. The reason for this dramatic rise in house prices, according to O’Neil, is a chronic undersupply of homes. “For a long time in our country, we have not been building enough homes,” she said, noting that Australia now has fewer homes per person than comparable nations like Canada, the UK, and France. The lack of sufficient housing stock has had a direct impact on affordability. “Fewer homes mean less affordable housing because the same number of buyers and renters are spread across fewer homes,” Minister O’Neil explained. “It sounds trite – but what happens when we build more homes? Housing becomes more affordable.” The federal government has set an ambitious target to facilitate the construction of 1.2 million new homes between July 2024 and 2029. However, many experts doubt whether this goal is achievable, given the current rate of construction and the ongoing challenges in the residential development sector. Australia’s housing shortage has far-reaching implications for both buyers and renters, and the need for immediate action is becoming more pressing as housing affordability continues to deteriorate.

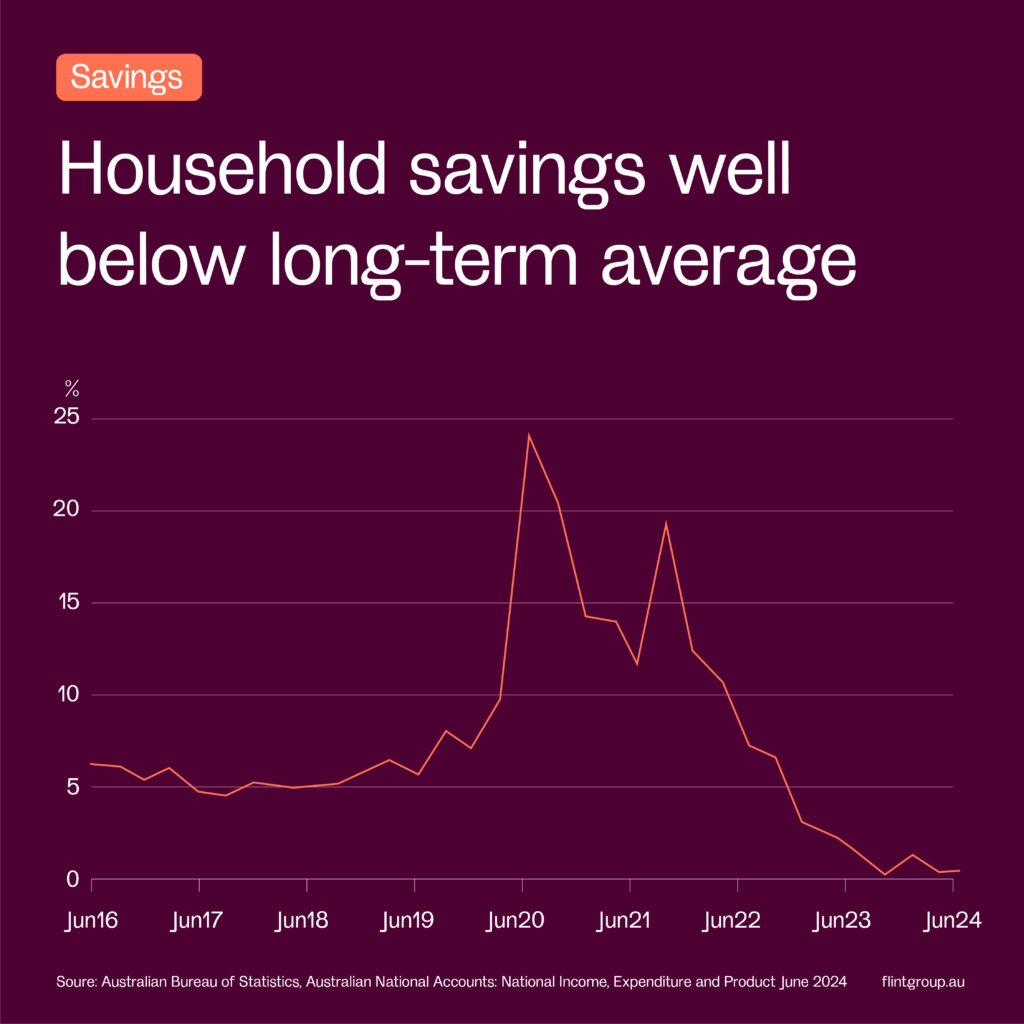

Household Savings Well Below Long-Term Average

Reading Time: 4 minutesIn a clear sign of how tight household finances have become for many Australians, the latest data from the Australian Bureau of Statistics (ABS) reveals that the average household saved just 0.6% of their income in the June quarter. This marks a significant drop from previous years and highlights the growing financial strain on households due to rising interest rates and cost-of-living pressures. During the pandemic in 2020, when strict lockdowns were enforced and interest rates hit record lows, Australians drastically cut back on their spending. As a result, the household saving ratio skyrocketed to an all-time high of 24.1%. The combination of government stimulus packages and reduced opportunities for discretionary spending meant that many were able to accumulate substantial savings. However, the situation has changed dramatically since then. As illustrated in the graph below, household savings have been steadily declining, largely due to rising interest rates and increasing inflation. These factors have eroded disposable income and left households with less money to put aside for savings. How Does This Compare to Historical Averages? Looking at the long-term data, the average household saving ratio since 2000 has been around 5.0%. The current level of 0.6% is well below that average, indicating that many households are feeling the pinch. Despite this, it’s worth noting that there have been more challenging periods in the past. In fact, since 2000, there have been 14 quarters where the household saving ratio was negative, meaning Australians were spending more than they earned. So, while savings levels are low right now, they haven’t yet fallen to the point where people are going into debt to cover day-to-day expenses. What Could the Future Hold for Household Savings? With inflation beginning to ease and some analysts predicting a potential rate cut on the horizon, there is cautious optimism that household saving rates might improve in the near future. Lower interest rates would reduce mortgage repayments and other borrowing costs, potentially freeing up more disposable income for savings. However, much will depend on broader economic conditions and how quickly cost-of-living pressures subside. For now, many Australians continue to feel the financial squeeze, and saving money has become more challenging than ever

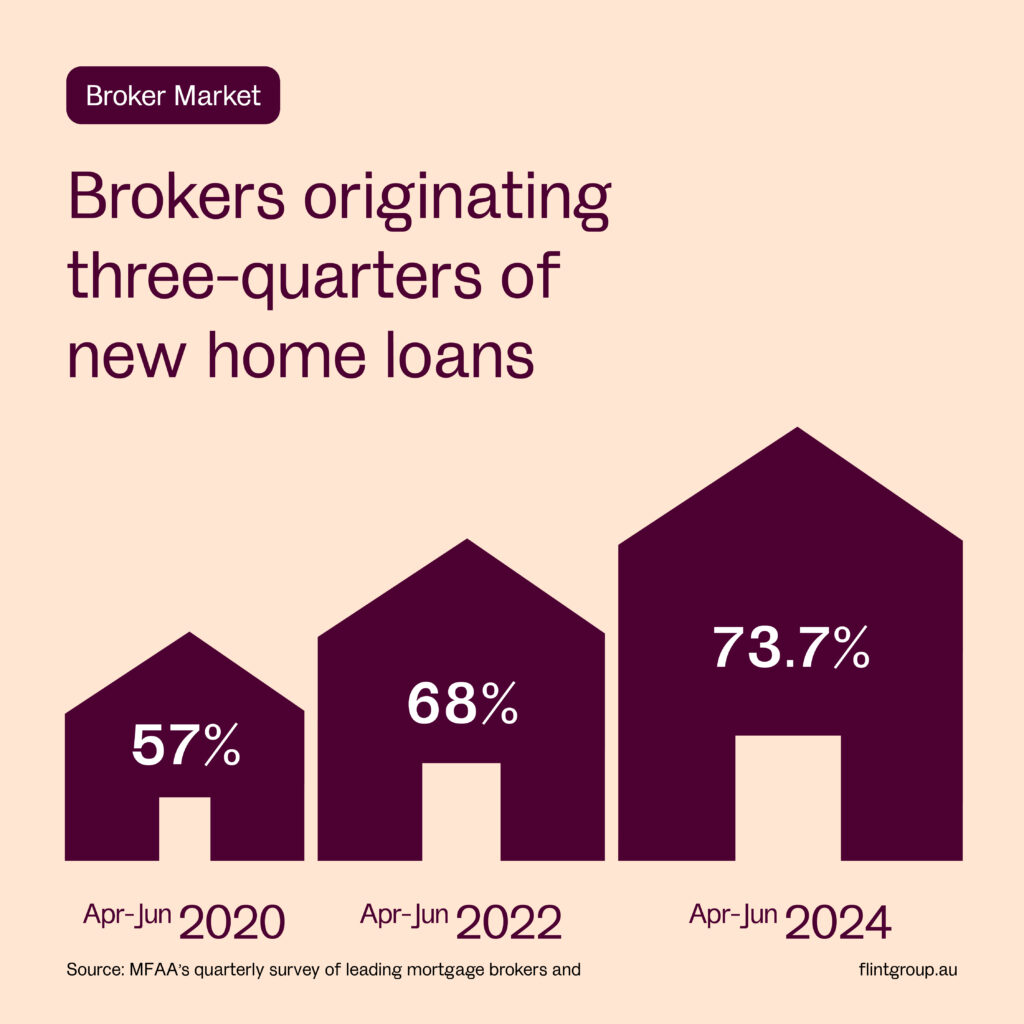

Brokers Now Originate Nearly Three-Quarters of New Home Loans

Reading Time: 2 minutesMortgage brokers have cemented their place as the go-to source for home loans, with their market share increasing significantly over the past four years. In the June 2024 quarter, brokers originated 73.7% of all new home loans, according to data from Comparator, commissioned by the Mortgage & Finance Association of Australia. This marks a significant rise from June 2020, when brokers were responsible for 57.0% of new loans. This shift is largely due to growing consumer awareness that brokers provide a broader range of options and superior service compared to traditional banks. When consumers approach a bank directly, they’re limited to that bank’s loan products. However, mortgage brokers can compare loans from multiple lenders, increasing the chances of finding the most suitable loan with better terms and rates. With more Australians recognising the value of this service, brokers are now helping a vast majority of home buyers navigate the complexities of the mortgage market, ensuring they secure the best possible deal for their financial situation. As the Australian property market continues to evolve, mortgage brokers are playing a crucial role in helping borrowers save time, reduce stress, and potentially save thousands on their home loans.

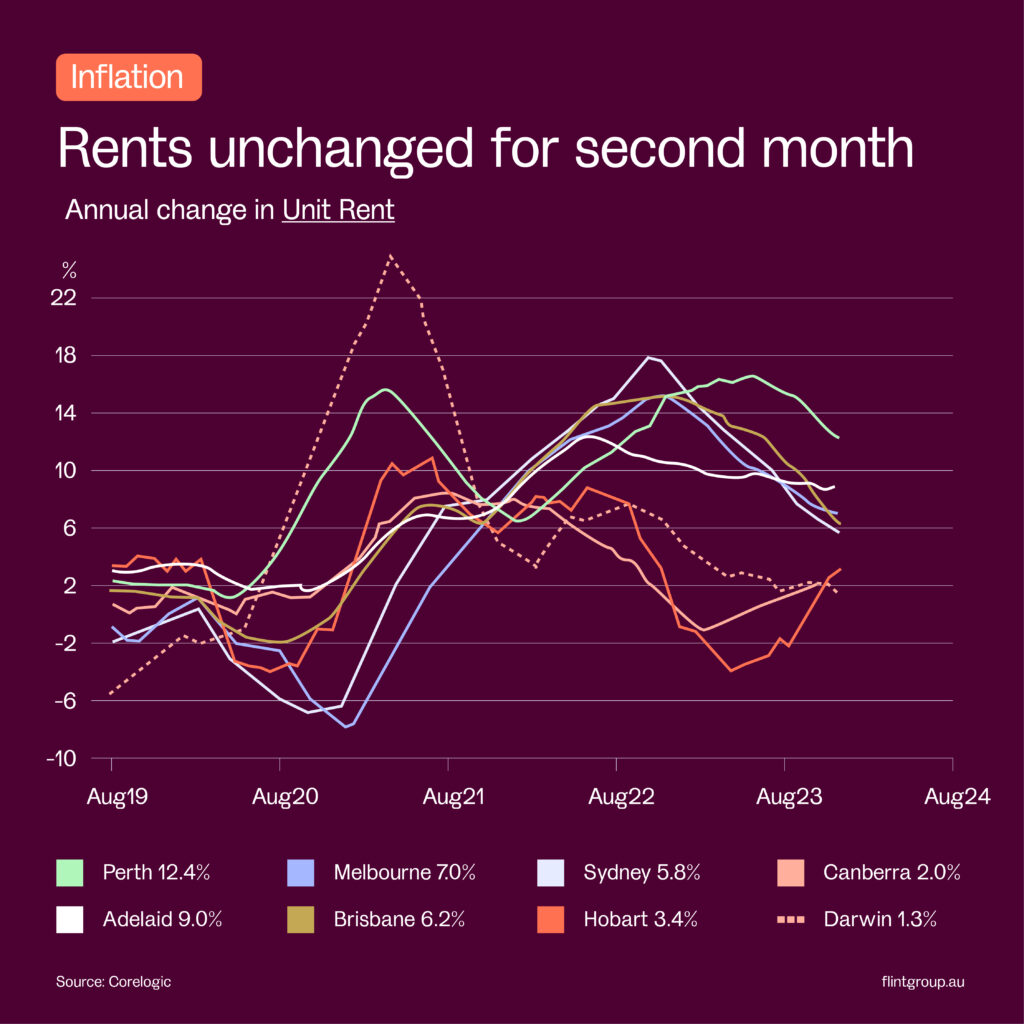

Rents Remain Unchanged for Second Straight Month

Reading Time: 2 minutesAt first glance, the rental market might appear to be booming, with many areas having experienced strong rental growth over the past year. However, the latest data suggests this trend may be slowing down. In August, the national median rent remained unchanged for the second consecutive month, according to CoreLogic. While rents didn’t decrease, they also did not increase. CoreLogic noted that while monthly rental data can be impacted by seasonal factors, the annual growth trend also indicates a consistent cooling in the pace of rent increases. Over the 12 months to August, national rent values rose by 7.2%—the lowest annual growth rate since May 2021. This slowdown is occurring in every capital city market except Hobart, which is recovering from a dip in rents seen throughout 2023. The rental slowdown is attributed to two main factors: Although rents are still higher year-on-year, this slowdown could provide some relief to tenants after a period of rapid rent increases.